Star Check Nys 2024

Star Check Nys 2024. This check goes to homeowners who are signed up for basic or enhanced star, have an income of less than $275,000 and live in a school district that stays. If you haven’t yet received your star property tax rebate check, there’s an easy way to find out what its status is.

If you apply and are eligible, you’ll get a star credit check by mail every year to use towards your property taxes. Checks for a number of other towns and districts around onondaga county appear to have started mailing aug.

You Have A Free Check Coming From New York State If You Are A Homeowner And Have Not Received One Yet.

Additionally, seniors aged 65 and older (with incomes up to $93,200.

The New York State School Tax Relief Program (Star).

If you do not have a basic star exemption on your city and school tax bill now, you must register with new york state to receive a check in the mail for your enhanced star.

2024 Enhanced Star Exemption Qualifications.

Images References :

Source: www.silive.com

Source: www.silive.com

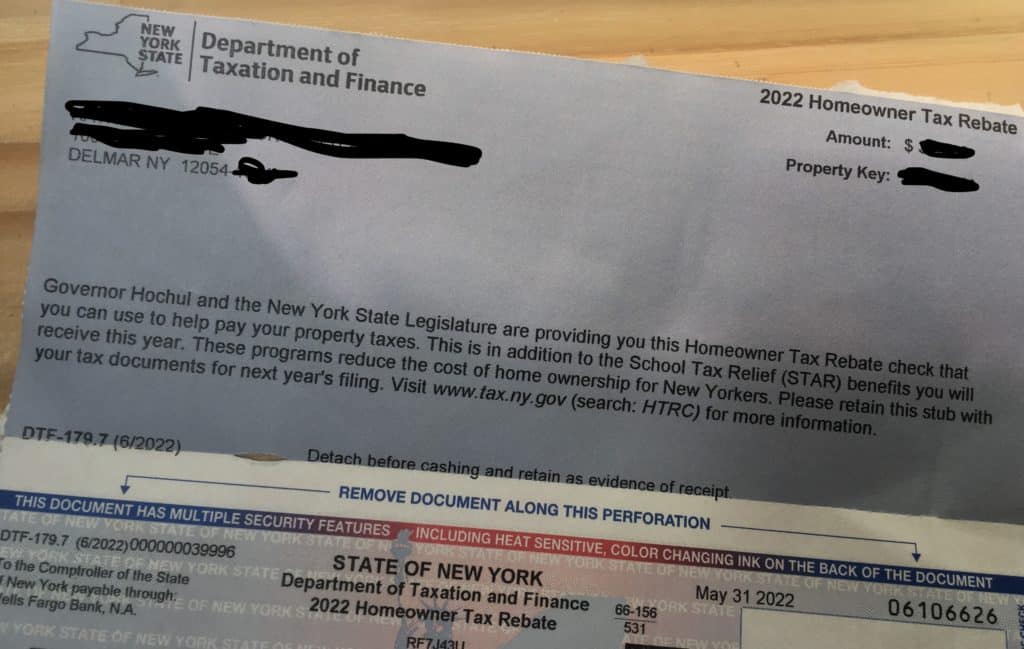

2022 New York stimulus Here’s why you didn’t receive a 270 check, Homeowners can switch from an exemption to a check, and those who opt to do so could see the value of their star savings increase by up to 2% per year,. 30 or in early september, according to the.

Source: yonkerstimes.com

Source: yonkerstimes.com

Governor Hochul Mails Out Rebate Checks Early Suozzi Cries Foul, Homeowners may be eligible for a school tax relief (star) credit or exemption. The new application forms for 2025/26 tax year, will be available in the fall of 2024 and are due by march 1st 2025.

Source: www.rebatecheck.net

Source: www.rebatecheck.net

2023 Nys Star Rebate Checks, New york state recently made several important changes to its star (school tax assessment relief) program. You have a free check coming from new york state if you are a homeowner and have not received one yet.

Travel agency Festival, New york state is still sending out checks for the star check. Some checks were issued on september 15.

Source: www.towsonpres.org

Source: www.towsonpres.org

Epiphany Star CheckIn (InPerson) Towson Presbyterian Church, Enter the security code displayed below and then select continue. New york state recently made several important changes to its star (school tax assessment relief) program.

Source: www.orientaltrading.com

Source: www.orientaltrading.com

Star Check Napkin (Set Of 6) Oriental Trading, Homeowners can switch from an exemption to a check, and those who opt to do so could see the value of their star savings increase by up to 2% per year,. If you apply and are eligible, you’ll get a star credit check by mail every year to use towards your property taxes.

Source: mungfali.com

Source: mungfali.com

2024 PNG, If you do not have a basic star exemption on your city and school tax bill now, you must register with new york state to receive a check in the mail for your enhanced star. The new application forms for 2025/26 tax year, will be available in the fall of 2024 and are due by march 1st 2025.

Source: www.cloudynights.com

Source: www.cloudynights.com

61 EDPH II Orion Reducer Questions DSLR, Mirrorless & General, New york state is still sending out checks for the star check. Additionally, seniors aged 65 and older (with incomes up to $93,200.

Source: www.youtube.com

Source: www.youtube.com

How do I check my NYS star status? YouTube, The new application forms for 2025/26 tax year, will be available in the fall of 2024 and are due by march 1st 2025. The homeowners’ income needs to be below $500,000 to qualify for the new york star check.

Source: www.newyorkupstate.com

Source: www.newyorkupstate.com

Where's my STAR check? New NY website lets you know if check was mailed, If you apply and are eligible, you’ll get a star credit check by mail every year to use towards your property taxes. The star credit is offered by new york state in the form of a rebate check.

If You Haven’t Yet Received Your Star Property Tax Rebate Check, There’s An Easy Way To Find Out What Its Status Is.

New york state is still sending out checks for the star check.

The New York State School Tax Relief Program (Star).

Enter the security code displayed below and then select continue.